How Can I Send Money To Gcash Internationally

Are you wondering how to send money to Gcash internationally? Look no further! In this comprehensive guide, we will walk you through the step-by-step process of sending money to Gcash from anywhere in the world. Whether you're an overseas Filipino worker (OFW) or simply want to send money to your loved ones in the Philippines, Gcash provides a convenient and secure platform to transfer funds.

Understanding Gcash and Its International Remittance Service

With the increasing number of Filipinos working and living abroad, the need for a reliable and efficient method to send money back home has become crucial. Gcash, a mobile wallet and financial service in the Philippines, offers an international remittance service that allows individuals to send money from anywhere in the world. This service has revolutionized the way overseas Filipinos support their families and loved ones back home.

What is Gcash?

Gcash is a mobile wallet and financial service offered by Globe Telecom, one of the leading telecommunications companies in the Philippines. It allows users to perform various financial transactions, such as sending money, paying bills, purchasing goods and services, and even investing. With over 40 million users, Gcash has become one of the most popular mobile wallets in the Philippines.

The Benefits of Using Gcash for International Money Transfers

There are several benefits to using Gcash for international money transfers:

- Convenience: Gcash allows you to send money to the Philippines anytime, anywhere, as long as you have an internet connection and a Gcash account.

- Speed: International money transfers through Gcash are typically processed within minutes, ensuring that your loved ones receive the funds quickly.

- Security: Gcash employs strict security measures to protect your transactions and personal information, giving you peace of mind when sending money internationally.

- Cost-Effectiveness: Gcash offers competitive exchange rates and lower transaction fees compared to traditional remittance methods, helping you save money on transfer costs.

Requirements for Sending Money Through Gcash

Before you can start sending money to Gcash internationally, you need to fulfill certain requirements:

- Gcash Account: You must have a verified Gcash account to use the international remittance service. If you don't have an account yet, don't worry! We'll guide you through the process of setting up your Gcash account in the next section.

- Valid Identification: To comply with regulatory requirements, you'll need to provide a valid identification document, such as a passport or government-issued ID, to verify your identity when setting up your Gcash account.

- Source of Funds: You should have a reliable source of funds to transfer to your Gcash wallet. This can be from your bank account, credit card, or other available funding options supported by Gcash.

Fees, Limits, and Restrictions

When sending money to Gcash internationally, it's important to be aware of the fees, limits, and restrictions that may apply:

- Transaction Fees: Gcash charges a minimal fee for international money transfers, which varies depending on the amount you're sending and the selected transfer method. These fees are transparently displayed before confirming your transaction, ensuring that you're aware of any charges.

- Transfer Limits: Gcash has certain limits on the amount of money you can send internationally. These limits may vary depending on factors such as your account verification level, funding source, and recipient's Gcash account status. It's essential to check the specific limits applicable to your account.

- Country Restrictions: Gcash supports international money transfers to a wide range of countries. However, there might be certain restrictions or limitations for specific countries due to regulatory requirements or partner network availability. It's advisable to check the list of supported countries on the Gcash website or contact customer support for the most up-to-date information.

Setting Up Your Gcash Account for International Transactions

Before you can start sending money to Gcash internationally, you need to set up your Gcash account properly. Follow these steps to get started:

Step 1: Download and Install the Gcash App

The first step is to download and install the Gcash app on your mobile device. The Gcash app is available for both iOS and Android devices and can be found on their respective app stores. Once downloaded, open the app to begin the registration process.

Step 2: Register for a Gcash Account

When you open the Gcash app, you'll be prompted to register for a Gcash account. Follow the on-screen instructions to provide the required information, such as your mobile number and email address. Make sure to double-check the accuracy of the information before proceeding.

Step 3: Verify Your Identity

After registering for a Gcash account, you'll need to verify your identity to unlock the full features of the app, including the international remittance service. To do this, you'll be asked to provide a valid identification document, such as a passport or government-issued ID. Follow the instructions to take a clear photo or scan of your ID and submit it through the app.

Step 4: Set Up Your Gcash PIN

Once your identity is verified, you'll be prompted to set up a Gcash Personal Identification Number (PIN). The PIN is a four-digit code that serves as a security measure to protect your Gcash account. Choose a PIN that is easy for you to remember but difficult for others to guess. Avoid using obvious combinations, such as your birthdate or consecutive numbers.

Step 5: Fund Your Gcash Wallet

Before you can start sending money to Gcash internationally, you need to have funds in your Gcash wallet. There are several options available to fund your Gcash wallet:

- Bank Transfer: Link your bank account to your Gcash wallet and transfer funds directly from your bank. This option may require additional verification steps, such as providing bank statements or undergoing a bank authorization process.

- Remittance Centers: Some remittance centers allow you to deposit money directly to your Gcash wallet. Check with your local remittance centers to see if they offer this service.

- Online Payment Platforms: Gcash has partnered with various online payment platforms, such as PayPal and Alipay, allowing you to transfer funds from these platforms to your Gcash wallet.

Step 6: Link Your Gcash Account to Your Mobile Number

To ensure the security and accessibility of your Gcash account, it's recommended to link it to your mobile number. This allows you to easily recover your account or perform transactions using your mobile number as an identifier. Follow the instructions in the Gcash app to link your mobile number to your Gcash account.

Initiating an International Money Transfer to Gcash

Now that you have a verified Gcash account and funded your Gcash wallet, it's time to initiate an international money transfer to Gcash. Follow these steps to send money to Gcash internationally:

Step 1: Open the Gcash App and Log In

Launch the Gcash app on your mobile device and log in using your Gcash mobile number and PIN. Make sure you have a stable internet connection to ensure a smooth transaction.

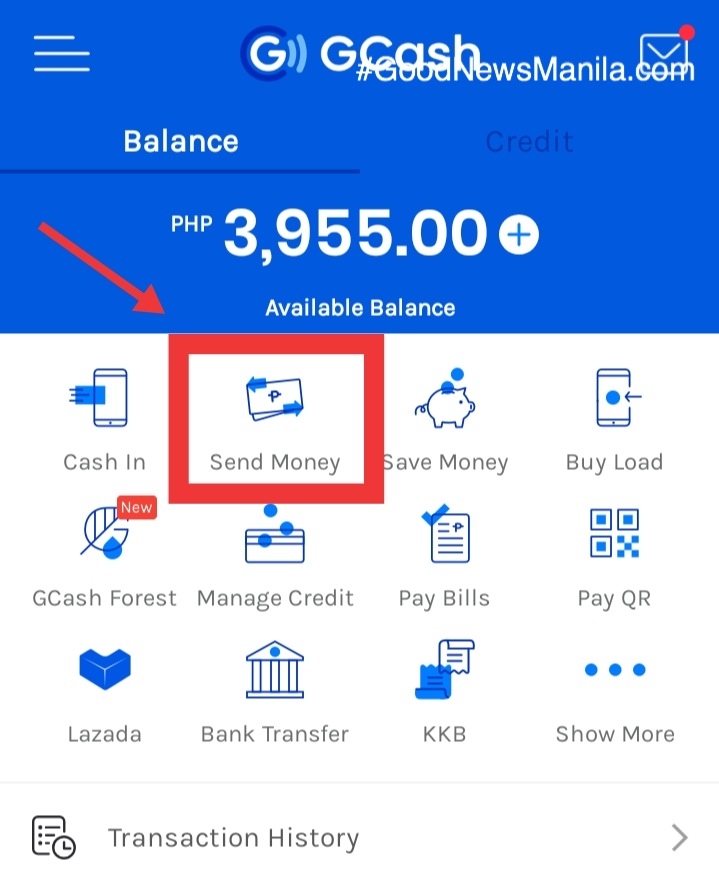

Step 2: Access the International Remittance Service

Once logged in, navigate to the international remittance service within the Gcash app. This service is usually found in the main menu or home screen, clearly labeled for easy access.

Step 3: Select Your Preferred Transfer Method

Gcash offers multiple transfer methods for sending money internationally. Choose the method that best suits your needs and preferences. The available options may include bank transfers, remittance centers, or online payment platforms. Each method may have different requirements, fees, and processing times, so it's important to review the details before proceeding.

Step 4: Input the Recipient's Gcash Details

To ensure the funds are credited to the correct Gcash account, you'll need to input the recipient's Gcash details accurately. This typically includes the recipient's mobile number linked to their Gcash account. Double-check the information before confirming the transaction to avoid any delays or errors.

Step 5: Review and Confirm the Transaction

Before finalizing the transfer, carefully review the transaction details, including the amount, fees, and exchange rates, if applicable. Take note of any additional information or instructions provided by Gcash regarding the selected transfer method. Once you're satisfied with the details, confirm the transaction to initiate the international money transfer.

Step 6: Wait for the Transfer to be Processed

After confirming the transaction, you'll need to wait for the transfer to be processed. The processing time may vary depending on the selected transfer method, but Gcash aims to complete international money transfers within minutes. During this time, it's important to keep your Gcash app open and maintain a stable internet connection to ensure the transaction is successfully processed.

Step 7: Receive Confirmation of Successful Transfer

Once the transfer is successfully processed, you'll receive a confirmation notification from Gcash. This notification will indicate that the funds have been credited to the recipient's Gcash wallet. You can also check the transaction history within the Gcash app to verify the completion of the transfer.

Tracking and Confirming Your Gcash International Transfer

After sending money to Gcash internationally, it's essential to track and confirm the status of your transfer. Follow these steps to monitor the progress of your international transfer:

Step 1: Open the Gcash App and Log In

Launch the Gcash app on your mobile device and log in using your Gcash mobile number and PIN. Make sure you have a stable internet connection to ensure a smooth transaction.

Step 2: Access the Transaction History

Once logged in, navigate to the transaction history section within the Gcash app. This section usually displays a list of your recent transactions, including both incoming and outgoing transfers.

Step 3: Locate Your International Transfer

Scroll through the transaction history to locate the specific international transfer you wish to track. Look for the transaction details, such as the recipient's Gcash mobile number and the transfer amount, to identify the correct transaction.

Step 4: Check the Status of the Transfer

Within the transaction details, you should be able to see the status of the transfer. Gcash provides different status indicators, such as "pending," "processing," or "completed," to keep you informed about the progress of your international transfer. If the transfer is still in progress, be patient and wait for the transaction to be completed.

Step 5: Contact Gcash Customer Support (if needed)

If you encounter any issues or have concerns about your international transfer, don't hesitate to contact Gcash customer support. They are available to assist you and provide updates regarding the status of your transfer. You can reach out to Gcash customer support through various channels, such as email, phone, or social media.

Withdrawing Gcash Funds Internationally

Once the funds are successfully credited to the recipient's Gcash wallet, you might wonder how to withdraw them internationally. Follow these steps to access and utilize the transferred funds conveniently:

Step 1: Open the Gcash App and Log In

Launch the Gcash app on your mobile device and log in using your Gcash mobile number and PIN. Make sure you have a stable internet connection to ensure a smooth transaction.

Step 2: Navigate to the Withdrawal Options

Once logged in, locate the withdrawal options within the Gcash app. This section usually provides a list of available methods to withdraw funds from your Gcash wallet.

Step 3: Choose Your Preferred Withdrawal Method

Gcash offers various withdrawal methods, depending on your location and the available services in your area. Common withdrawal methods include cash pick-up services, ATM withdrawals, and linking Gcash to a bank account. Select the method that is most convenient for you and your recipient.

Step 4: Follow the Instructions for the Chosen Method

Each withdrawal method may have specific instructions and requirements. Follow the instructions provided by Gcash for the selected withdrawal method. This may involve providing additional information, such as the recipient's identification details for cash pick-up services or linking a bank account for direct transfers.

Step 5: Wait for the Withdrawal to be Processed

After initiating the withdrawal, you'll need to wait for the process to be completed. The processing time may vary depending on the chosen withdrawal method. It's important to be patient and allow sufficient time for the funds to be successfully withdrawn.

Step 6: Confirm the Successful Withdrawal

Once the withdrawal is successfully processed, you'll receive confirmation from Gcash. This confirmation may come in the form of a notification within the Gcash app or an email. Make sure to check your notifications or email inbox regularly to stay updated on the status of the withdrawal.

Frequently Asked Questions (FAQs)

Q1: What is the maximum amount I can send to Gcash internationally?

A1: The maximum amount you can send to Gcash internationally may vary depending on various factors, such as your account verification level, funding source, and recipient's Gcash account status. It's advisable to check the specific limits applicable to your account to ensure a successful transfer.

Q2: How long does it take for an international money transfer to Gcash to be processed?

A2: International money transfers through Gcash are typically processed within minutes. However, the actual processing time may vary depending on factors such as the selected transfer method, country-specific regulations, and partner network availability. Gcash strives to complete transfers as quickly as possible to ensure your loved ones receive the funds promptly.

Q3: Can I cancel an international money transfer to Gcash?

A3: Once a transfer is confirmed and initiated, it may not be possible to cancel the transaction. However, if you have concerns or encounter any issues with the transfer, it's recommended to contact Gcash customer support immediately. They can assist you and provide guidance based on your specific situation.

Q4: Are there any fees involved when sending money to Gcash internationally?

A4: Gcash charges a minimal fee for international money transfers, which varies depending on the amount you're sending and the selected transfer method. These fees are transparently displayed before confirming your transaction, ensuring that you're aware of any charges. It's advisable to review the fee details for your specific transfer before proceeding.

Q5: Can I send money to Gcash internationally using a credit card?

A5: Yes, Gcash supports funding your Gcash wallet using a credit card. However, it's important to note that using a credit card for international money transfers may incur additional fees and charges from your credit card provider. It's advisable to check with your credit card company regarding any applicable fees or restrictions before proceeding with the transfer.

Section: Tips for a Secure and Smooth Gcash International Transaction

When sending money to Gcash internationally, it's essential to prioritize security and ensure a smooth transaction. Follow these tips to enhance the security and smoothness of your Gcash international transactions:

Tip 1: Keep Your Gcash Account Information Confidential

It's crucial to keep your Gcash accountinformation confidential. Avoid sharing your Gcash mobile number, PIN, or any other sensitive information with anyone. Be cautious of phishing attempts or fraudulent messages asking for your Gcash account details. Gcash will never ask for your personal information through unsolicited messages or calls.

Tip 2: Enable Two-Factor Authentication

Two-factor authentication adds an extra layer of security to your Gcash account. Enable this feature to require a verification code, in addition to your PIN, when logging in or performing certain transactions. This helps protect your account from unauthorized access even if someone knows your PIN.

Tip 3: Regularly Update Your Gcash App

Keeping your Gcash app updated ensures you have the latest security patches and features. Developers frequently release updates to address any vulnerabilities or improve the overall performance of the app. Set your app to automatically update or regularly check for updates manually.

Tip 4: Verify Recipient's Gcash Details

Before initiating an international money transfer to Gcash, double-check the recipient's Gcash details, especially the mobile number linked to their account. Inputting the wrong details can result in delays or even credited funds to the wrong recipient. Take the time to verify the accuracy of the information to ensure a successful transfer.

Tip 5: Familiarize Yourself with Gcash Support Channels

If you encounter any issues or have questions about your international transfer, familiarize yourself with Gcash's support channels. Gcash provides various support options, such as email, phone, or social media, to assist users. Knowing how to reach out to customer support ensures prompt assistance and resolution to any concerns you may have.

Tip 6: Keep Records of Your Transactions

It's always a good practice to keep records of your international money transfers to Gcash. Take screenshots or save transaction confirmations for future reference. These records can serve as proof of the transaction and help resolve any disputes or discrepancies that may arise.

Comparing Gcash with Other International Money Transfer Services

Gcash is not the only option for sending money internationally. There are several other services available, each with its own features and benefits. Here, we compare Gcash with other popular international money transfer services:

Gcash vs. PayPal

PayPal is a widely recognized and popular platform for online payments and money transfers. While both Gcash and PayPal offer international money transfer services, there are some key differences to consider. Gcash is primarily focused on the Philippines and offers local services beyond money transfers, such as bill payments and financial investments. PayPal, on the other hand, operates on a global scale and caters to various countries and currencies. Consider your specific needs, including the recipient's location and available services, when choosing between Gcash and PayPal.

Gcash vs. Western Union

Western Union is a long-established and trusted name in the remittance industry. They offer a vast network of physical locations for sending and receiving money internationally. While Western Union provides convenience in terms of cash pick-up options, Gcash offers the advantage of digital transactions and a mobile wallet that can be accessed anytime, anywhere. Consider factors such as speed, cost, and accessibility when deciding between Gcash and Western Union.

Gcash vs. TransferWise

TransferWise is an online money transfer service known for its competitive exchange rates and low fees. Unlike Gcash, which focuses on the Philippines, TransferWise operates in multiple countries and supports various currencies. TransferWise may be a suitable option if you frequently send money to different countries or need to convert currencies. However, if your primary purpose is to send money to Gcash in the Philippines, Gcash provides a more targeted and convenient solution.

Gcash International Money Transfer Success Stories

Real-life success stories can inspire and reassure individuals looking to send money to Gcash internationally. Here are a few examples of how Gcash has made a positive impact on people's lives:

Success Story 1: Supporting Family From Afar

Juan, an overseas Filipino worker in the United States, has been using Gcash to support his family back home in the Philippines. By sending money through Gcash's international remittance service, Juan can easily provide financial assistance for his parents' medical expenses and his siblings' education. The speed and convenience of Gcash have allowed Juan to stay connected with his family and provide for their needs, even from thousands of miles away.

Success Story 2: Convenient Transactions for Business Owners

Maria, a small business owner based in Canada, relies on Gcash for international transactions with her suppliers and employees in the Philippines. With Gcash's seamless international money transfer service, Maria can pay for merchandise, manage payroll, and even settle bills from her overseas location. The cost-effectiveness and efficiency of Gcash have helped Maria streamline her business operations and maintain strong connections with her partners in the Philippines.

Success Story 3: Student Support Made Easy

Anton, a Filipino student pursuing higher education in Australia, benefits from Gcash's international remittance service to receive financial support from his parents back in the Philippines. Through Gcash, his parents can transfer funds directly to his Gcash wallet, allowing Anton to easily manage his expenses and tuition fees. The reliability and accessibility of Gcash have made Anton's student life abroad more convenient and worry-free.

Conclusion

Sending money to Gcash internationally is now easier than ever before, thanks to the convenience and reliability of Gcash's international remittance service. By following this comprehensive guide, you're equipped with the knowledge and step-by-step instructions to send money to Gcash from anywhere in the world. From understanding the benefits of using Gcash to setting up your account, initiating transfers, and withdrawing funds, you now have the tools to support your loved ones or manage your finances in the Philippines with ease. Stay connected with your family and provide financial assistance with confidence through Gcash's secure and efficient platform. Start sending money to Gcash internationally today, and make a positive impact on the lives of your loved ones back home!

Post a Comment for "How Can I Send Money To Gcash Internationally"

Post a Comment